Introduction

Bitcoin is the world’s first decentralized digital currency, allowing peer-to-peer transactions without banks or governments. Moreover, when it comes to Cryptocurrency, Bitcoin, without a doubt, is the largest Cryptocurrency by market capitalization. It has proven itself to be the top currency used by a large number of people worldwide compared to other digital currencies.

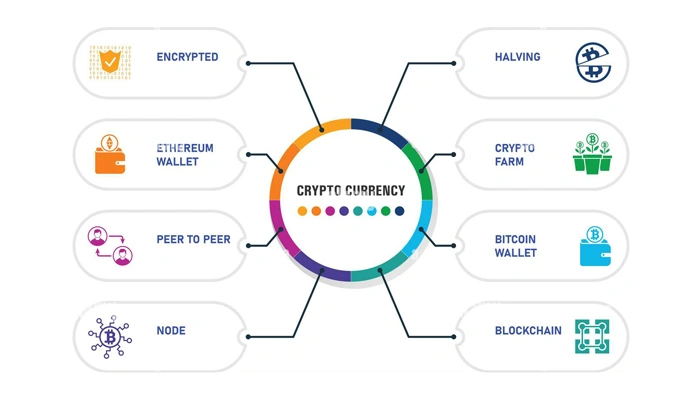

What is Cryptocurrency?

A well-known electronic payment system, Cryptocurrency does not rely on banks to confirm transactions. What makes it a top choice for people is that it is a peer-to-peer system that allows people from anywhere to send and get payments.

Moreover, Bitcoin was the first-ever Cryptocurrency, founded in 2009. Since its establishment till now, Bitcoin has constantly remained the top choice of people. So, if you are excited to know more about Bitcoin, let’s discuss it below in depth.

What is Bitcoin?

Bitcoin is a virtual or digital currency primarily designed and developed to work as a form of payment that any bank, group, or even an entity does not manage or control. Additionally, with its ease of use, Bitcoin has provided people with greater financial freedom, particularly in nations with unstable currencies or those with limited access to banking services.

Additionally, if you are wondering who invented Bitcoin, it is worth noting that the inventor or founder of Bitcoin is none other than Satoshi Nakamoto. He founded Bitcoin in 2008 with the aim of letting people easily send and receive payments from around the globe within seconds. He also aimed to remove the requirement for third parties, such as banks, in financial transactions.

Key Features of Bitcoin

Have a look at the top Bitcoin features:

- Decentralized: Bitcoin simply works on a peer-to-peer network, signifying it is not dependent on any authority or bank to control it.

- Digital: Bitcoin is completely digital; its physical appearance is not visible.

- Secure and Transparent: All Bitcoin transactions are recorded on a public ledger known as a blockchain, making it a secure and transparent way to invest.

- Fast and Global: You can send Bitcoin to anyone anywhere in the world quickly, even with lower charges as compared to traditional banking systems.

Purpose of Bitcoin

The most popular Cryptocurrency, Bitcoin, can be used for different purposes, like:

- Payments: A significant number of businesses today accept and utilize Bitcoin, along with other digital assets, as a mode of payment.

- Investing: Unlike gold, people also consider Bitcoin a crucial asset or investment due to its value and importance, particularly in challenging situations such as economic uncertainty.

- International payments: When it comes to international payment transfers, Bitcoin is considered the most convenient option for people because it is not subject to exchange rates or transaction charges.

- Remittances: Bitcoin has become a convenient and efficient way for individuals to send remittances to their friends and family in other nations.

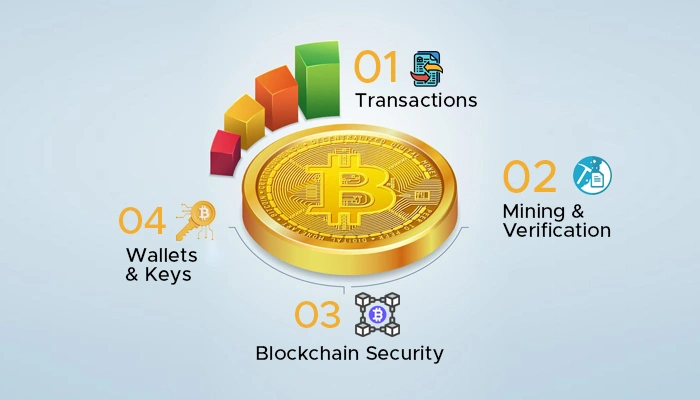

How Does Bitcoin Work?

Bitcoin operates on a decentralized peer-to-peer network powered by blockchain technology. Here’s a step-by-step breakdown:

1. Transactions

- When you send Bitcoin, the transaction is broadcast to the network.

- It’s grouped with others into a “block” for verification.

2. Mining & Verification

- Miners (computers) solve complex math problems to validate transactions.

- Once verified, the block is added to the public ledger (blockchain).

3. Blockchain Security

- Each block contains a cryptographic hash of the previous one, making tampering nearly impossible.

- Transactions are transparent (viewable by anyone) but pseudonymous (no real-world identities).

4. Wallets & Keys

- Your Bitcoin is stored in a digital wallet with two keys:

- Public key (like a bank account number, shared to receive funds).

- Private key (like a password, kept secret to authorize transactions).

Why It’s Revolutionary

✔ No banks or governments control it.

✔ Transactions are global, fast (10 mins–2 hours), and low-cost.

✔ Limited supply (only 21 million BTC), making it inflation-resistant.

Is Bitcoin a Good Investment?

Bitcoin is a high-risk, high-reward asset. Here’s a balanced analysis:

Pros (Opportunities)

- Scarcity-Driven Value: Like digital gold, Bitcoin’s fixed supply (21M) may drive long-term price growth.

- Institutional Adoption: Spot ETFs (e.g., BlackRock), Tesla, and PayPal now support Bitcoin.

- Hedge Against Inflation: Performs well during economic uncertainty (e.g., 2020–2024 bull run).

- Decentralization: Immune to government manipulation (unlike fiat currencies).

Cons (Risks)

- Volatility: Prices can swing 20%+ in a day (e.g., dropped 50% in 2022, rebounded in 2023).

- Regulatory Risks: Bans or restrictions in some countries (e.g., China, Nigeria).

- Security Threats: Hacks, scams, or lost private keys can wipe out holdings.

- Competition: Ethereum, Solana, and CBDCs could challenge Bitcoin’s dominance.

Who Should Invest?

- Risk-Tolerant Investors: Willing to hold long-term (5+ years).

- Diversified Portfolios: Allocate 1–10% (never invest more than you can afford to lose).

- Tech-Savvy Users: Comfortable with wallets, exchanges, and private keys.

Expert Tip: Use dollar-cost averaging (DCA) to reduce volatility impact (e.g., invest $100 weekly).

How to Buy Bitcoin?

Utilizing a cryptocurrency exchange is so far the best way for a person to purchase Bitcoin. The main reason behind this is that people sometimes are unable to buy a complete Bitcoin due to its high rate. Thus, it is better for them to purchase at least a portion of one Bitcoin on these exchanges using fiat currency, like U.S. dollars.

How to Mine Bitcoin?

In terms of mining Bitcoin, a vast number of hardware and software are required. Additionally, when the Bitcoin blockchain was published, it was easy for individuals to mine it using a personal device.

However, as it gained massive popularity, Bitcoin mining grew significantly, which, as a result, has decreased the chances of being the one to sort the mess. Furthermore, if you wish, you can also mine Bitcoin on your personal device, but ensure you have the latest hardware.

Bitcoin Risks vs Opportunity

Bitcoin (BTC) has emerged as a revolutionary digital asset, offering both immense opportunities and significant risks. As more investors consider adding Bitcoin to their portfolios, understanding its potential rewards and pitfalls is crucial. This guide explores Bitcoin’s risks, opportunities, and how to invest wisely—helping you make informed decisions in this volatile yet promising market.

Why Investors Are Interested

1. Decentralization & Financial Freedom

- Bitcoin operates on a decentralized blockchain, free from government or bank control.

- Offers an alternative to traditional banking, especially in countries with unstable currencies.

2. Scarcity & Store of Value

- Limited supply (only 21 million BTC will ever exist) mimics gold’s scarcity.

- Often called “digital gold,” Bitcoin is seen as a hedge against inflation.

3. High Growth Potential

- Historically, Bitcoin has delivered massive returns (e.g., from $1 in 2011 to over $60,000 in 2021).

- Institutional adoption (e.g., ETFs, Tesla, MicroStrategy) boosts credibility.

4. Global Accessibility

- Traded 24/7, unlike traditional markets.

- Enables fast, low-cost cross-border transactions.

Key Risks of Investing in Bitcoin

1. Extreme Price Volatility

- Bitcoin can surge or crash by 20%+ in a single day.

- Not ideal for risk-averse investors.

2. Regulatory Uncertainty

- Governments may impose restrictions (e.g., China’s crypto ban, U.S. SEC lawsuits).

- Tax policies on crypto gains vary widely.

3. Security Threats

- Exchange hacks (e.g., Mt. Gox, FTX collapse).

- Phishing scams, fake wallets, and lost private keys.

4. Liquidity & Market Risks

- Large sell-offs can trigger flash crashes.

- Smaller exchanges may lack liquidity.

5. Technological & Adoption Risks

- Competition from Ethereum, Solana, and CBDCs.

- Quantum computing could threaten Bitcoin’s security (long-term risk).

How to Invest in Bitcoin Safely

1. Start Small & Diversify

- Allocate only what you can afford to lose (e.g., 1-5% of your portfolio).

- Balance with stocks, bonds, and other assets.

2. Use Secure Storage

- Cold Wallets (Best Security): Ledger, Trezor.

- Reputable Exchanges: Coinbase, Kraken, Binance (with 2FA enabled).

3. Stay Informed

- Follow regulatory updates (SEC, IRS guidelines).

- Monitor macroeconomic trends (Fed policies, inflation).

4. Avoid Emotional Trading

- Dollar-cost averaging (DCA) reduces volatility impact.

- Set stop-losses and take-profit targets.

Frequently Asked Questions

Q1: What is Bitcoin and how does it work?

Ans: Bitcoin refers to a decentralized digital currency that uses blockchain, a distributed ledger secured by cryptographic techniques.

Q2: Can you convert Bitcoin into cash?

Ans: Yes, you can covert Bitcoin by exchanging it with fiat currencies.

Q3: What is the purpose of Bitcoin?

Ans: People use Bitcoin to send money to others, no matter where they live.