How to Become Tax Filer in Pakistan

How to become a tax filer in Pakistan. All individuals who want to start their businesses or firms who want to run their business smoothly without any disruptions must register themselves with the Federal Board of Revenue (FBR). Being a tax filer, you will get numerous benefits which will surely benefit you in every aspect. It will also help you stay up-to-date with all the taxes and laws about your businesses.

So, if you are looking for how to become tax filer in Pakistan 2025, then make sure to read this blog till the end to get yourself updated. So, without delay, let’s begin.

Who Can Become a Tax File? Are You Eligible?

The following people are considered to become a tax filer in Pakistan:

- People earning more than PKR 600,000 annually are eligible to be tax filers.

- Whoever is a resident of Pakistan or a non-resident with taxable income must file their tax return.

- People who are 18 years or older are required to file their taxes.

- People who own a small or big business must file their tax return in Pakistan to have a seamless business journey.

- Those people who own various property types are considered among the tax filers.

- Vehicle owners with an engine capacity of 1000 CC or more are required to file tax returns.

- Regardless of their specifics, all the non-profit organizations are also considered among the tax filers in Pakistan.

- The high electricity consumers whose electricity bills for both commercial and industrial go above Rs. 500,000 are also eligible for tax return.

How to Become Tax Filer ? A Step-by-Step Guide

The following are the 5 ways that How to become tax filer in Pakistan for 2025:

Method 1: Tax Filer Eligibility

The first method to become a filer in Pakistan is to check out the tax filer eligibility in the following two ways:

- Visit the FBR official website

- Get in touch with a professional

Method 2: Registration as a filer

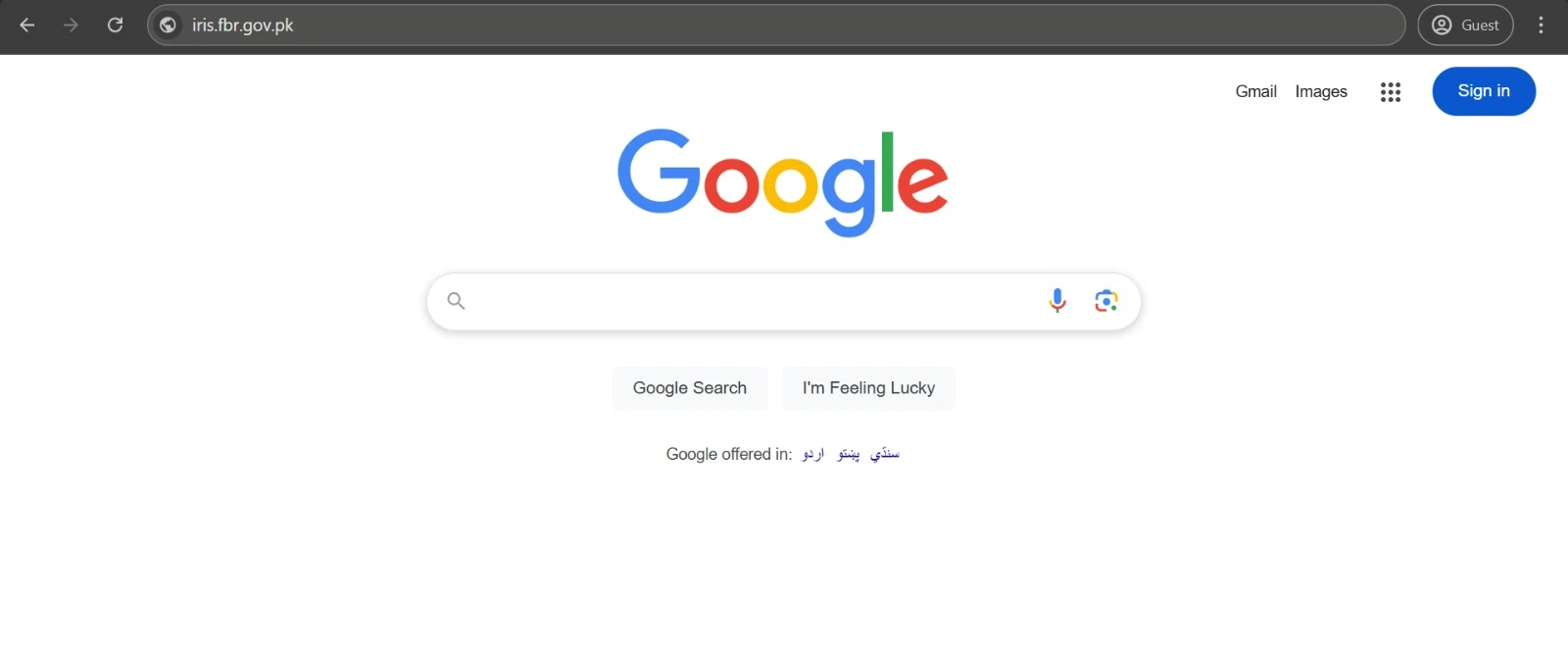

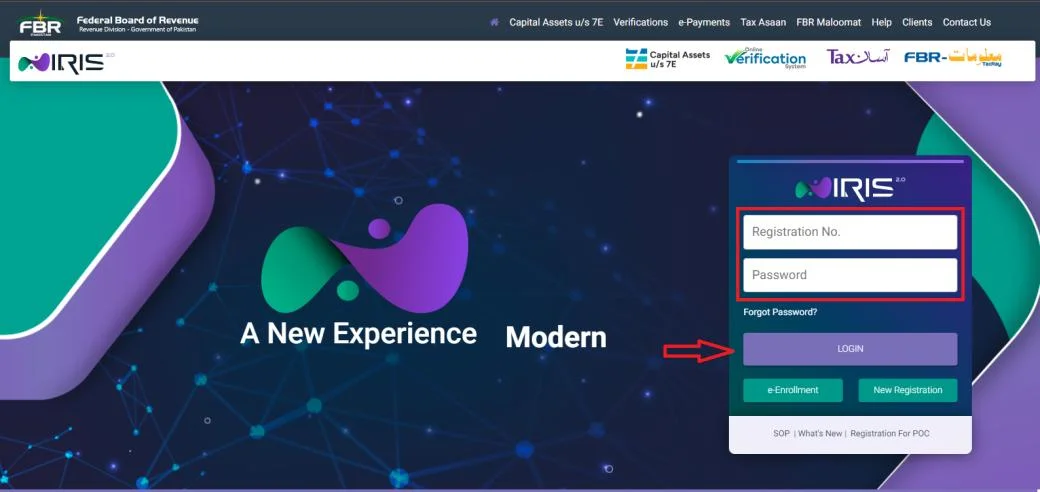

Step 1: Go to Google page and type “iris.fbr.gov.pk“

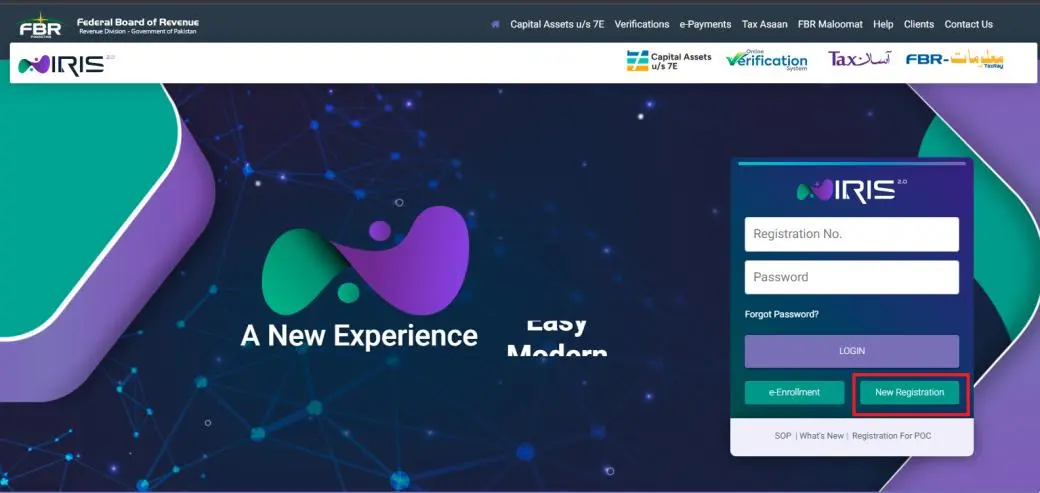

Step 2: Now, once the FBR page is opened, click on the New Registration option on the right side

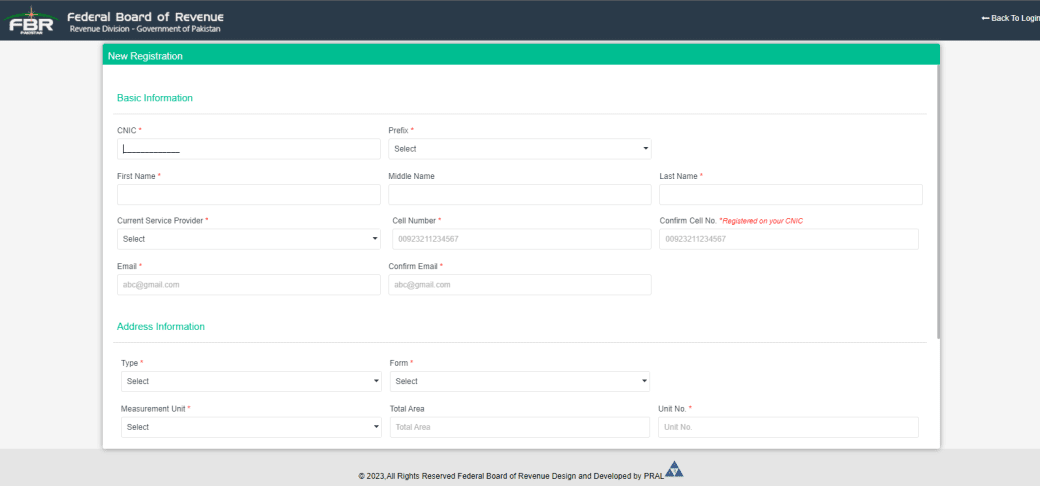

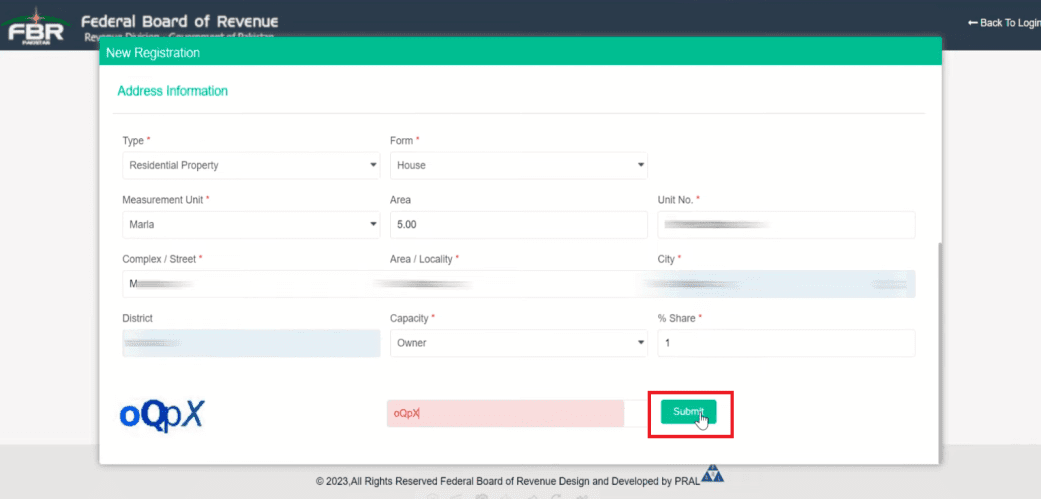

Step 3: After that, a new page will be opened. Here, you are required to share your details

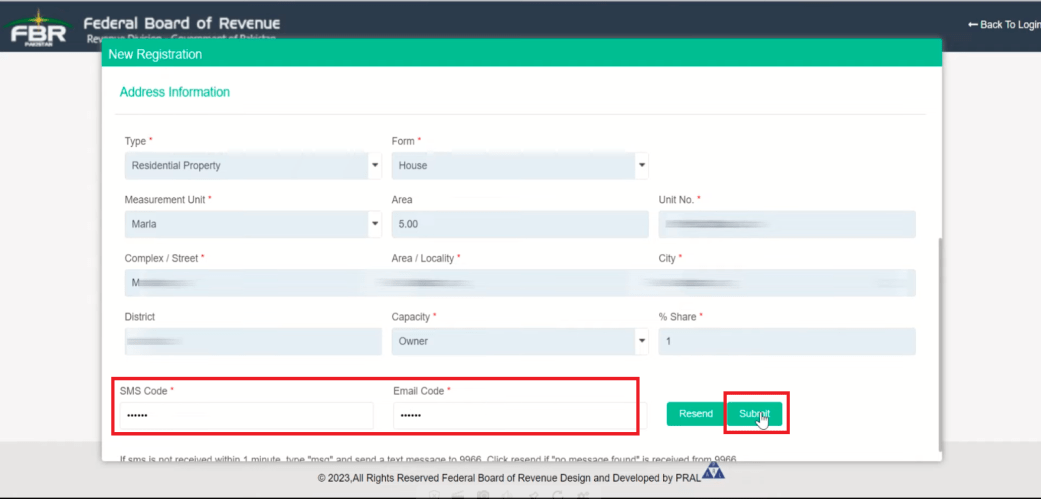

Step 4: Next, once done, click on Submit, and you will get a code for your contact number and email address

Step 5: After receiving the code, enter both codes you received via number and email address in their designated area. Once done, click on Submit

Method 3: Filling Income Tax Return

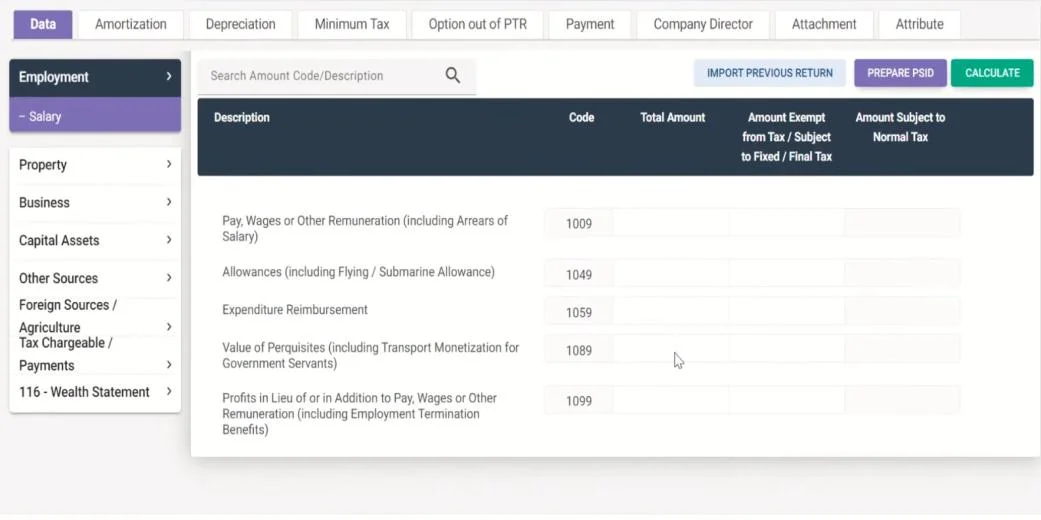

To fill out your income tax return form, make sure to follow the below 8 steps:

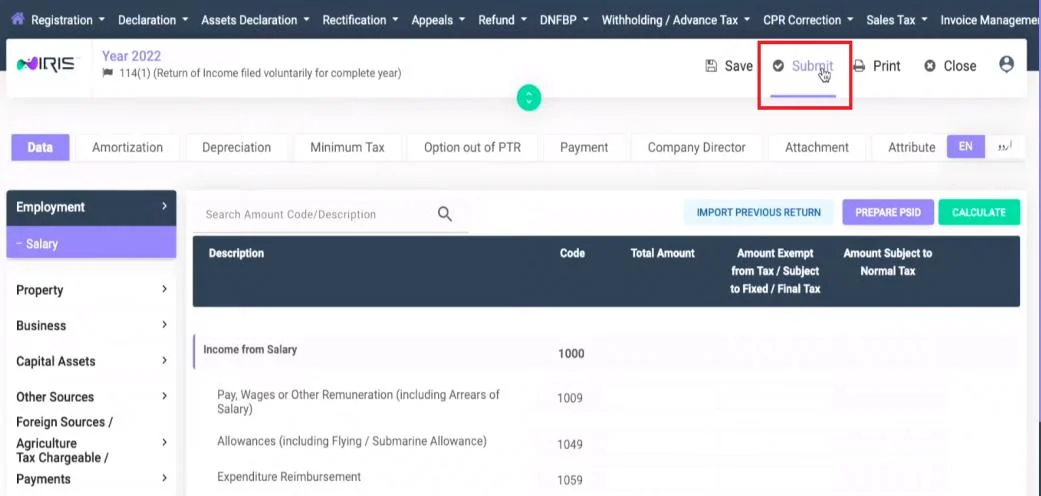

Step 1: Go back to the FBR official site and add your information in each box. Once done, click on Login to proceed

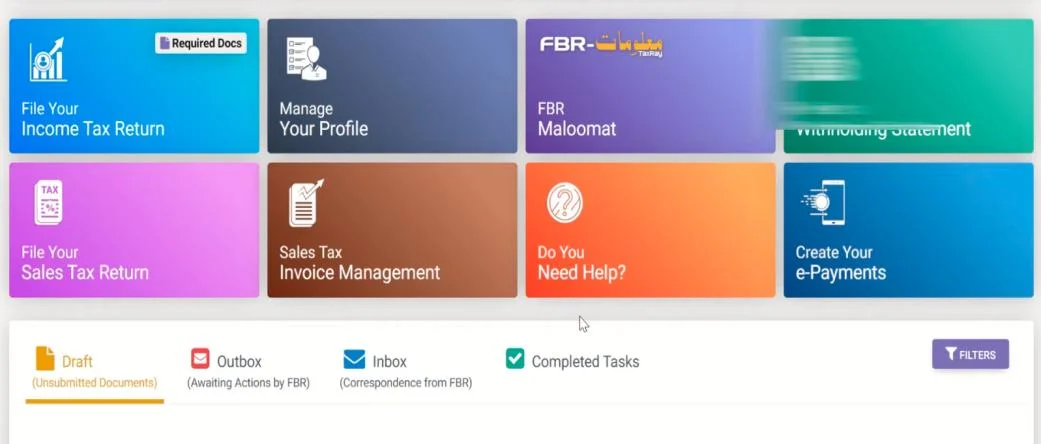

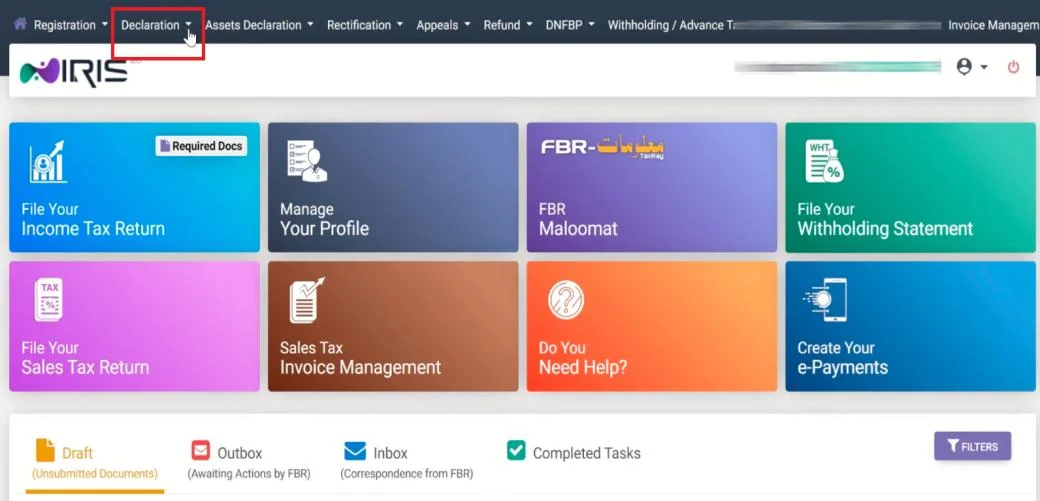

Step 2: Now, a new FBR interface will be opened where you will come across numerous options

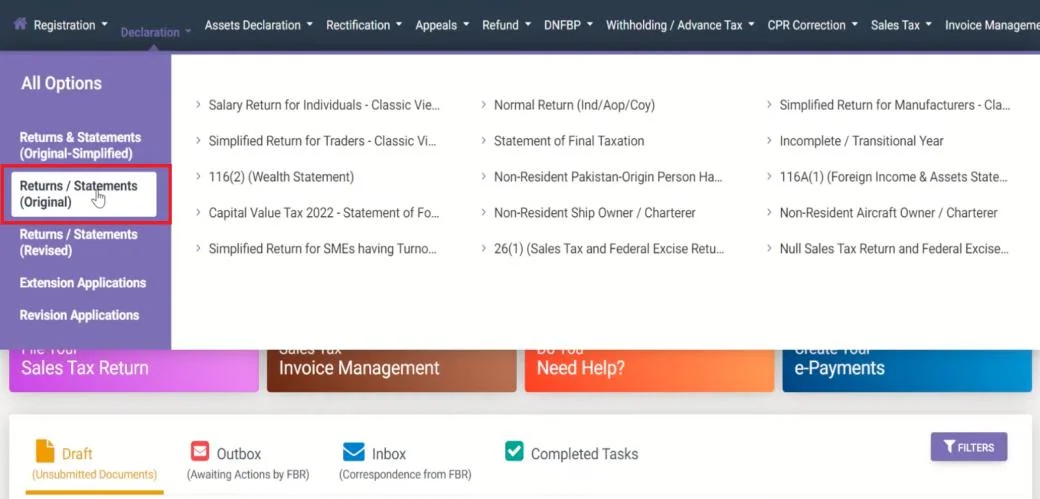

Step 3: Next, click on Declaration on the left and top side of the FBR interface page

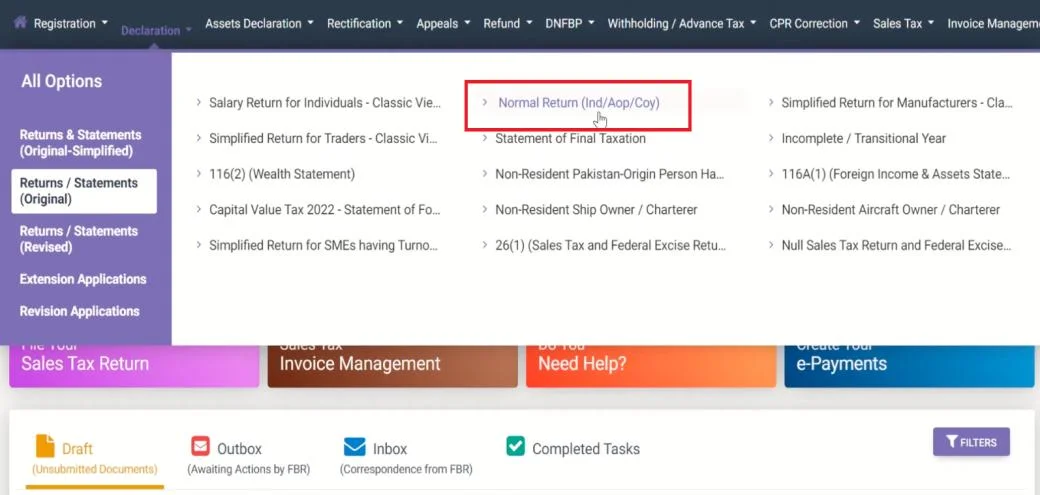

Step 4: Among the many options, click on Returns/Statements (Original)

Step 5: After that, click on Normal Return (Ind/Aop/Coy)

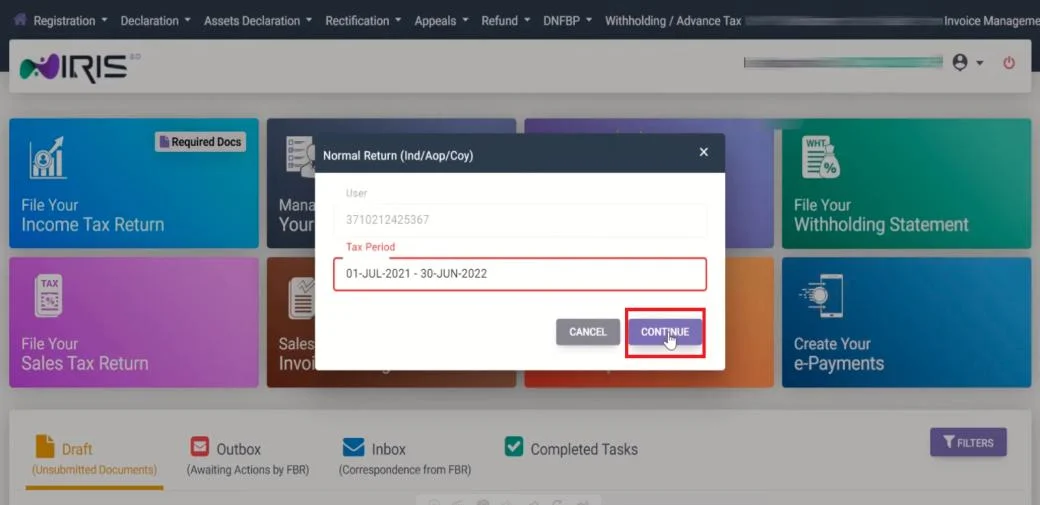

Step 6: Enter your tax period for the specific year you want to become a tax filer. Once you’re done, click on Continue

Step 7: Now, a return form will be opened. However, remember that these steps are for people with zero income and who do not own a property or business. Nevertheless, the procedures for people who own a property, car, or business differ.

Step 8: If you don’t own anything yet and want to be a filer, then put a Zero on each section and click Submit. After that, enter the code that you received in the early stage.

Method 4: ATL Surcharge and Challan Payment

It is pertinent to mention that you have not yet become a tax filer because you have just completed the registration and filed a return. However, now you must pay 1000 as an ATL Surcharge so that you can be listed on the ATL Active members list.

Check out the below 14 steps for ATL Surcharge and Challan Payment:

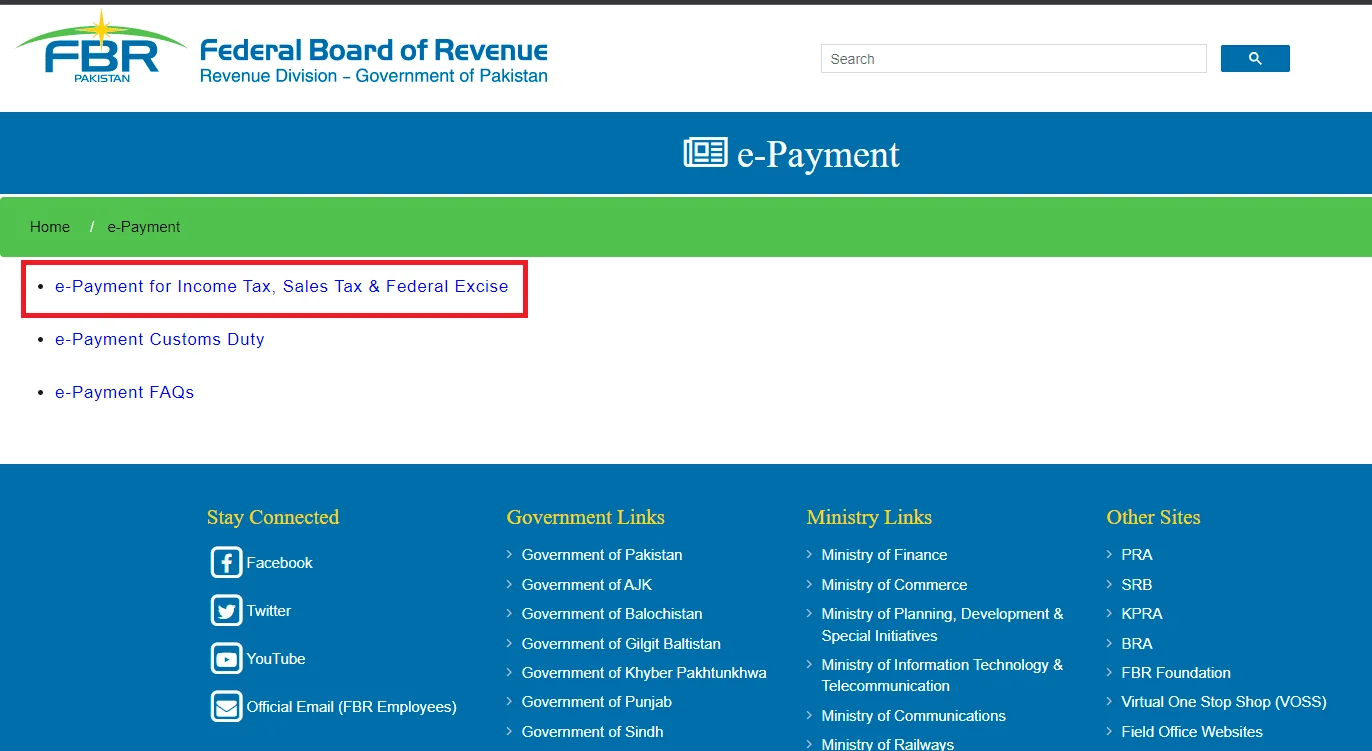

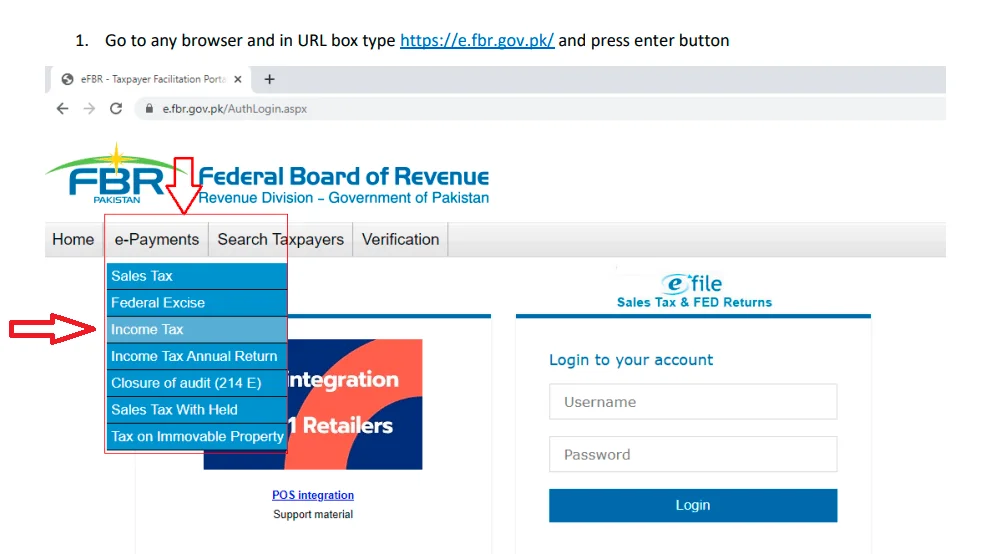

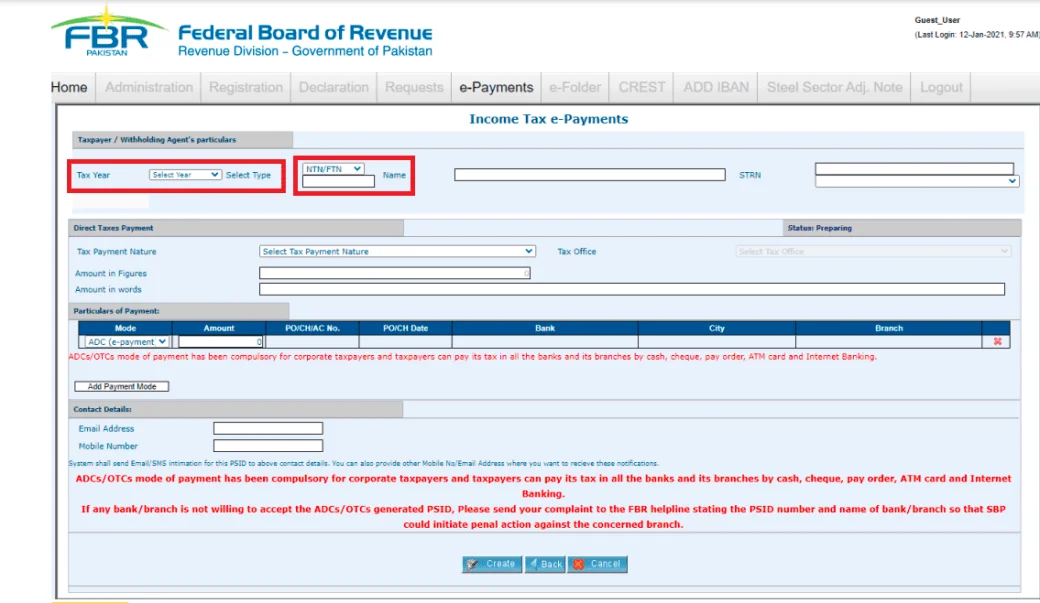

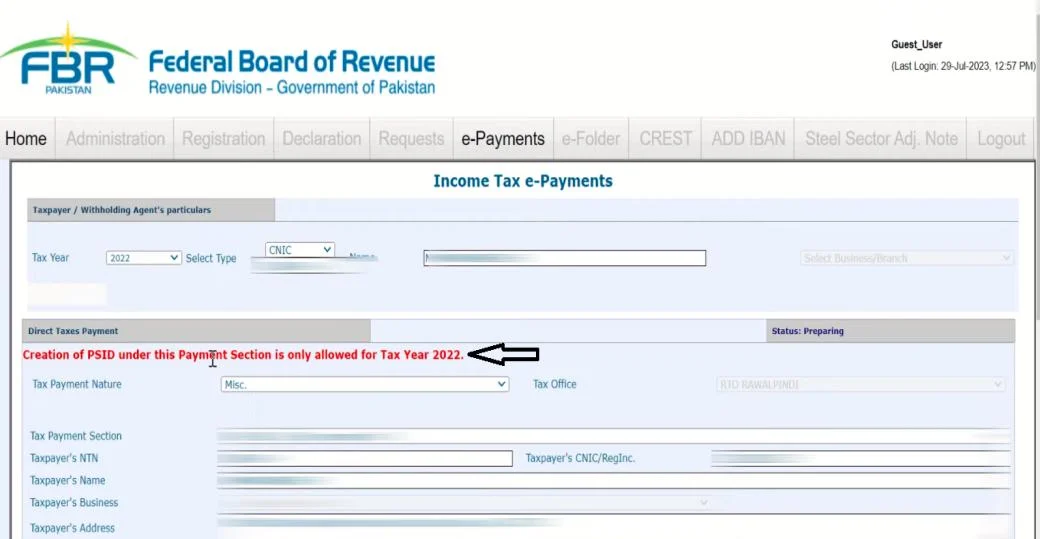

Step 1: Open the official site of FBR again and choose the E-Payment option

Step 2: Now, a new page will be opened, so click on the first option E-Payment for Income Tax, Sales, and Tax & Federal Excise

Step 3: Next, from the E-Payment section, click on the Income Tax option

Step 4: Click on Tax Year and enter your NTN/FTN, CNIC, or Reg. No information from Select Type” Drop-Down

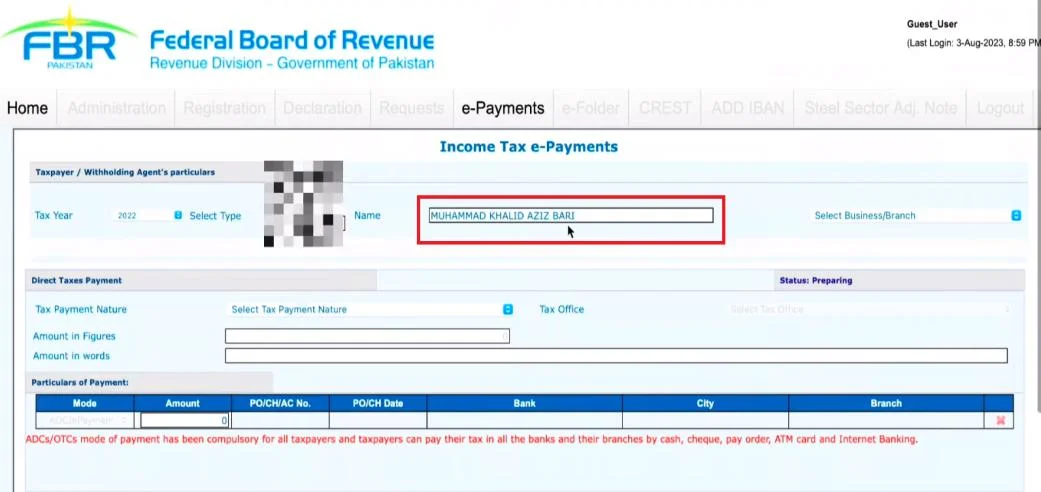

Step 5: Once done, press Tab, and then the system will automatically fill your name

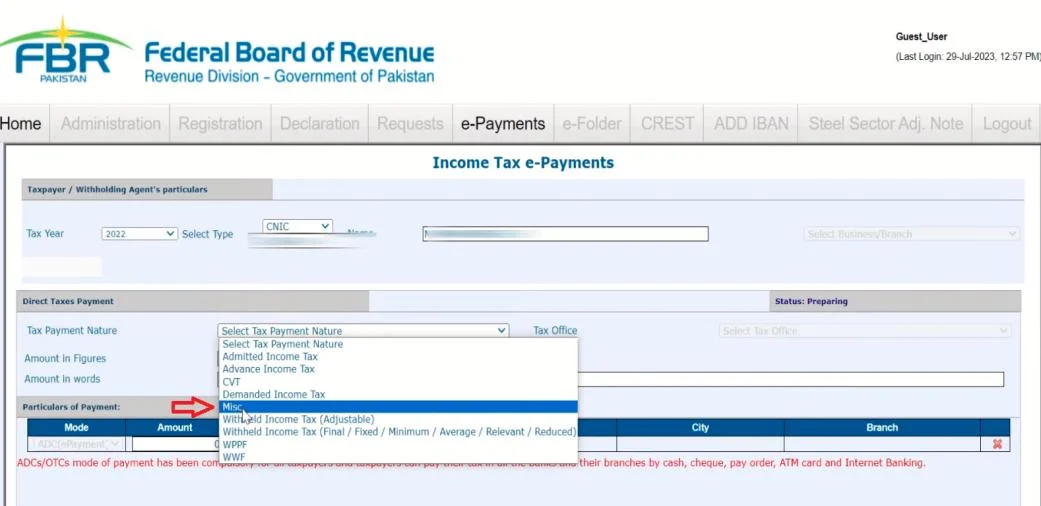

Step 6: From the Tax Payment Nature section, click on Misc

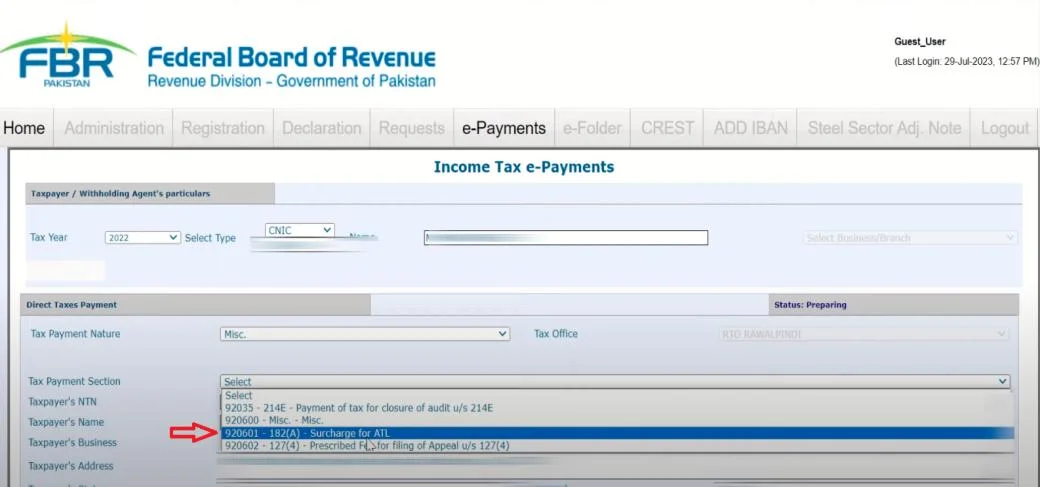

Step 7: Next, click on Surcharge for ATL

Step 8: After that, you’ll find a sentence in red. The text intends to inform you that you will create the challan payment you chose according to the earlier tax year, not for other years.

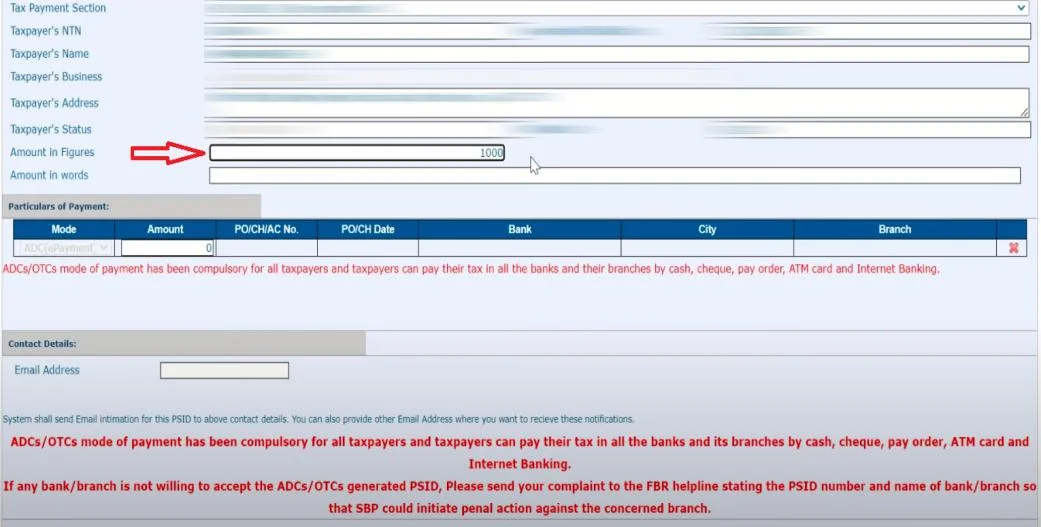

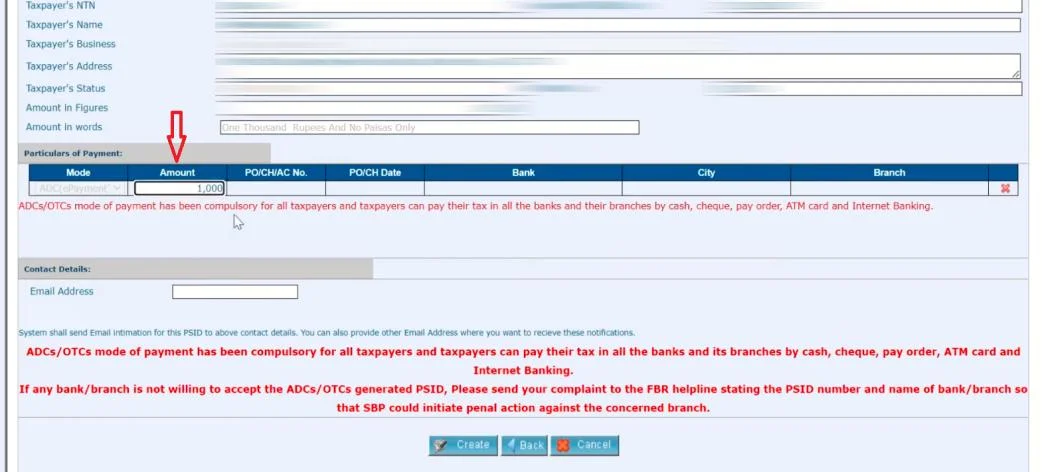

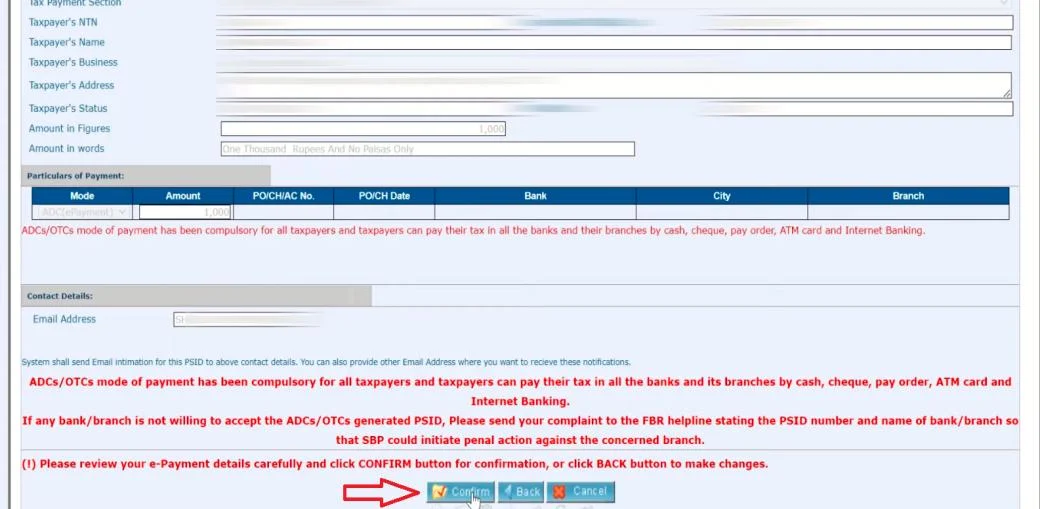

Step 9: Scroll down a bit and enter your challan amount, which is 1000 in Amount in Figure section

Step 10: Enter the same amount in the following section too

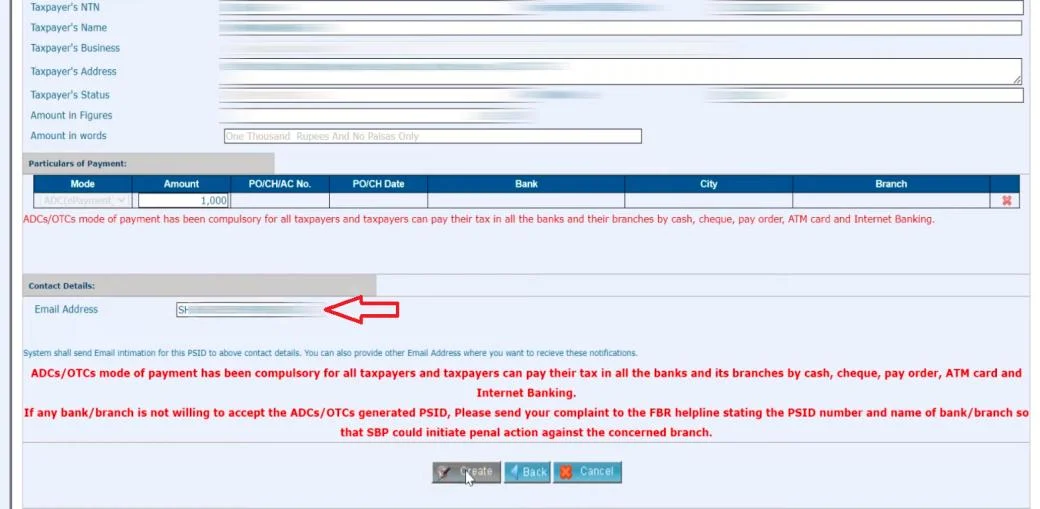

Step 11: Enter your email address in the following section

Step 12: Next, click on Confirm at the bottom of the page

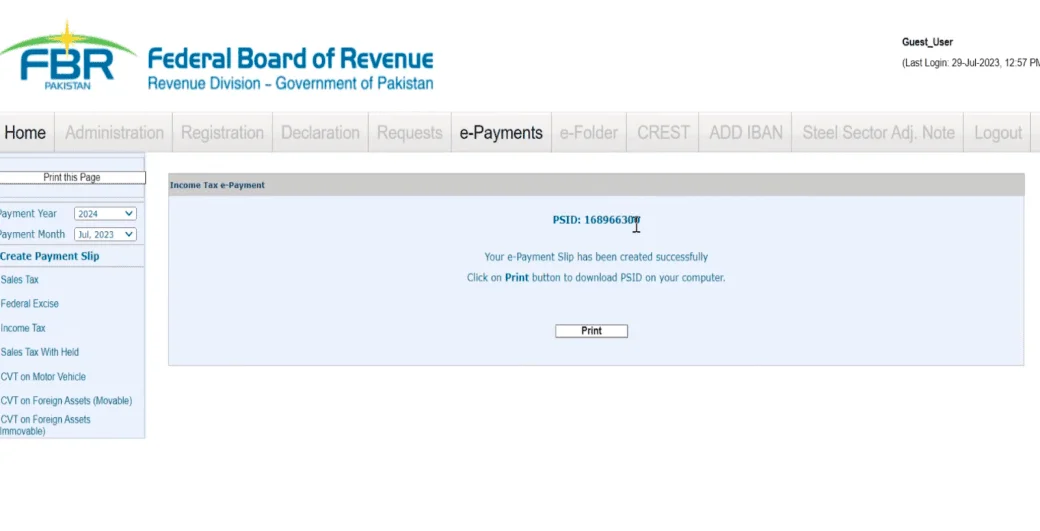

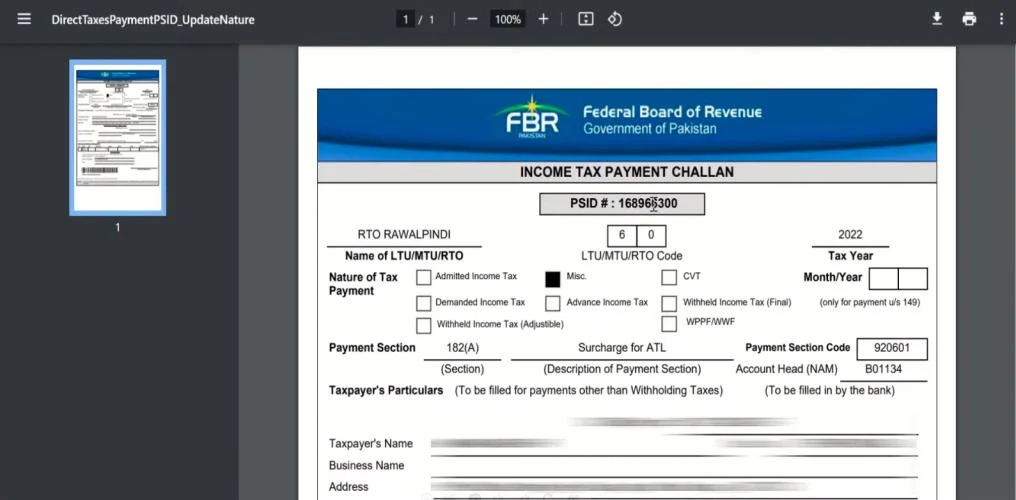

Step 13: After that, you will be able to see that PSID has been made

Step 14: You can now use the challan details to pay via authorized banks, mobile banking, or online banking. So, wait patiently for a moment, and your status will be active.

Method 5: National Tax Number (NTN) Verification

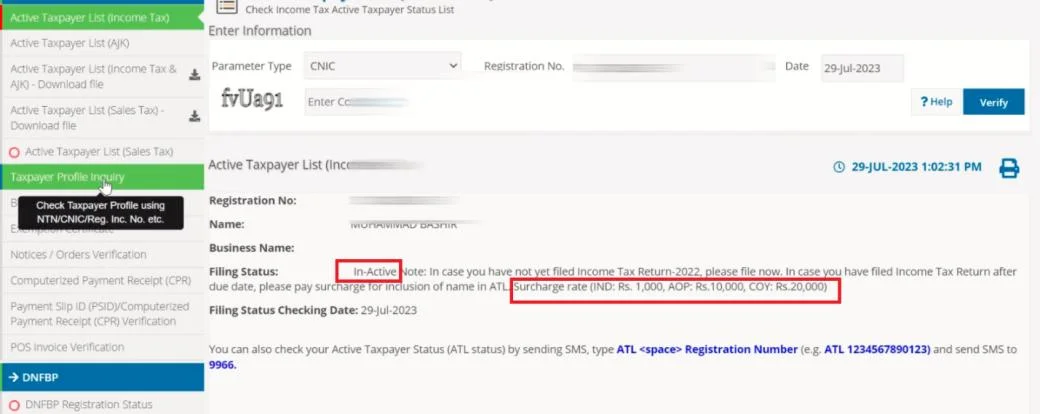

The National Tax Number (NTN) is important as you can use it for all your tax-related dealings, including filing tax returns, ensuring seamless tax transactions. So, in order to check active filer status whether your tax filer status is active or not, follow the below 7 steps:

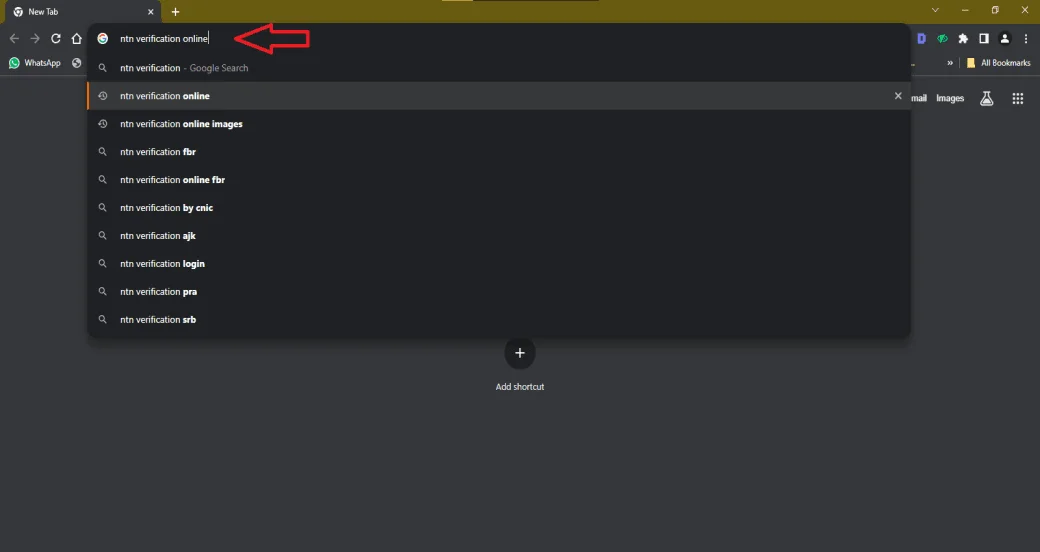

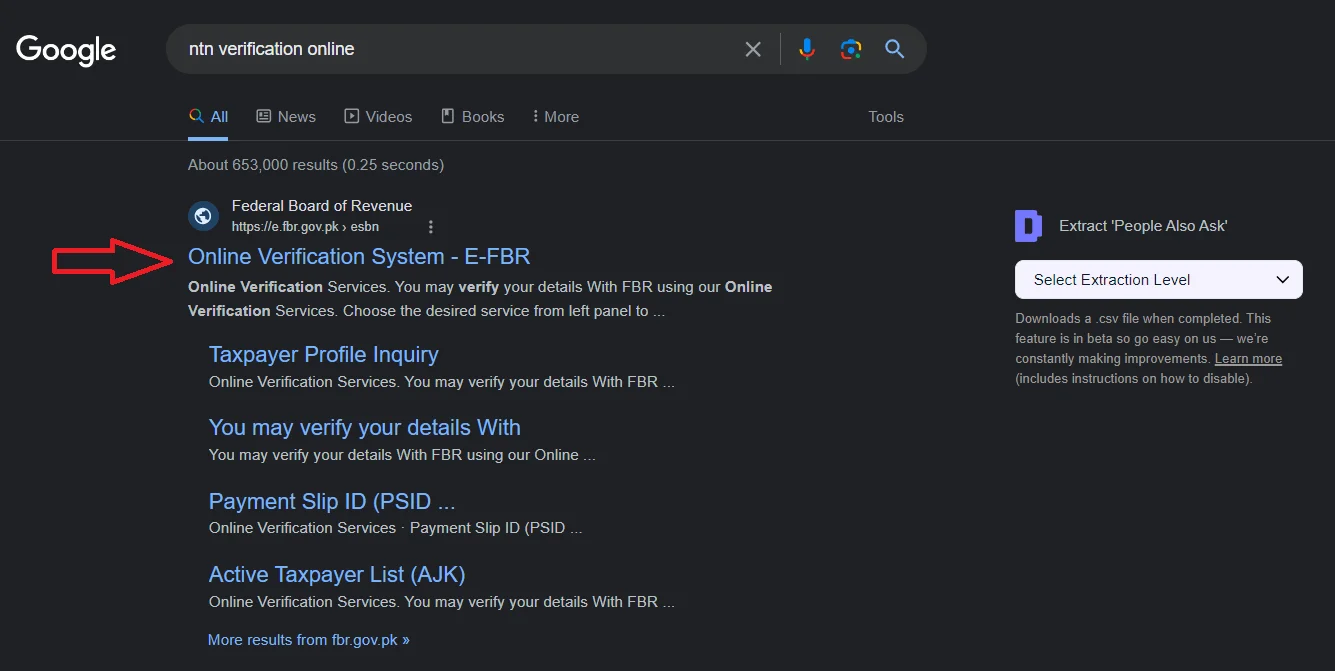

Step 1: Open the Google page and type NTN verification online to check your status and verify your NTN number

Step 2: Next, click on the Online Verification System FBR

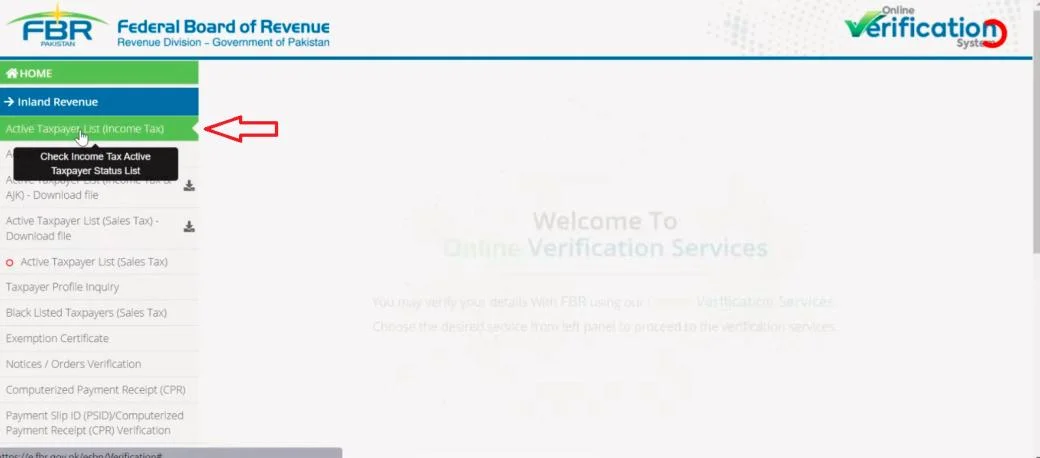

Step 3: Once the page opens, make sure to click on Active Taxpayer List online

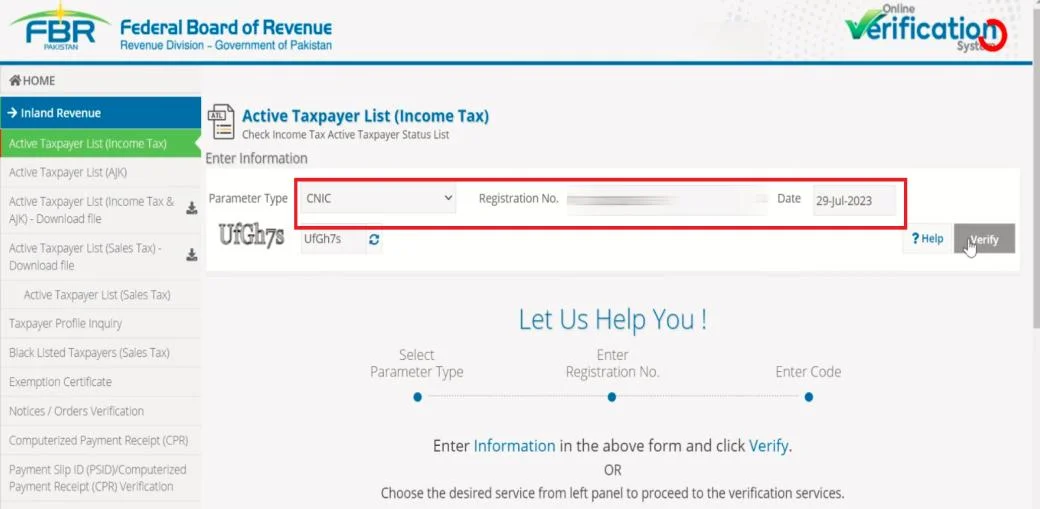

Step 4: Now, enter your details like CNIC number, registration number, and date

Step 5: Enter the CAPTCHA code and then click Verify on the right side of the page

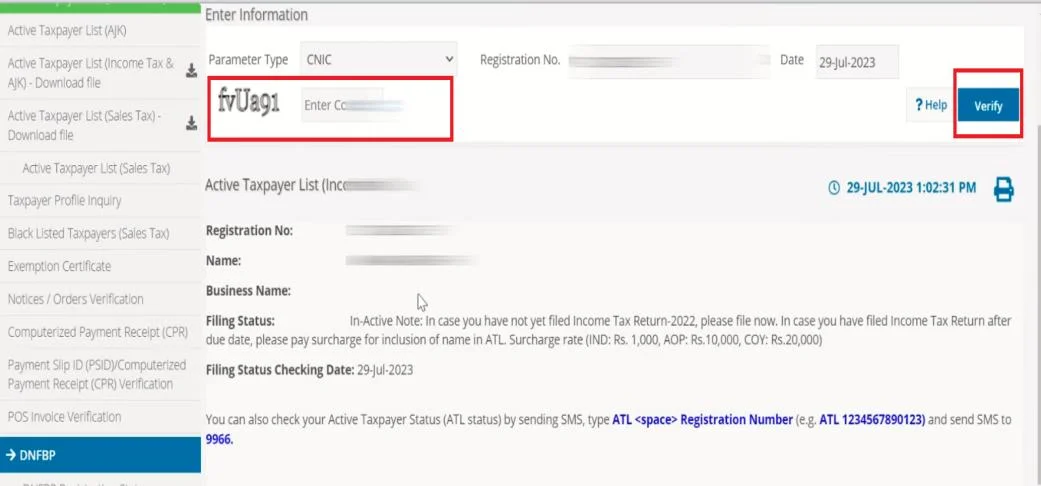

Step 6: After that, if it is shown that your status is active, then you better understand you have become a tax filer in Pakistan. However, if it is not, then make sure to pay the tax return considering the following amount.

Individual = 1000

Association of persons (AOP) = 10,000

Company = 20,000

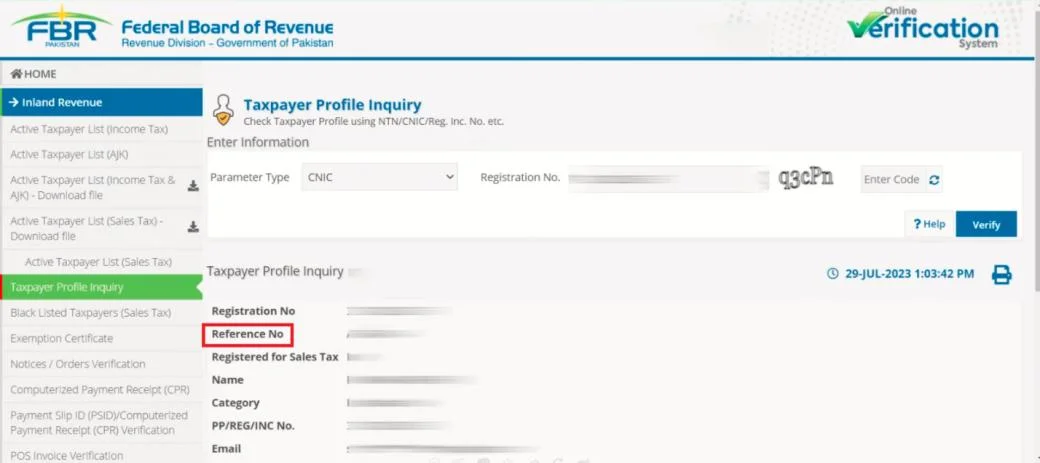

Step 7: Lastly, the Reference Number shown below is your FBR NTN number

Read More: How to become a filer in Pakistan

Why is it Important to Become a Filer? 10 Major Benefits

Below are the 10 main benefits that signify why it is important How to become a filer in Pakistan:

- Being a tax filer in Pakistan, you will get lower withholding tax rates on different transactions, including banking, property, and vehicles

- You will easily be eligible for several tax exemptions and deductions

- Being a tax filer in Pakistan will help you enhance your credit rating and allow you to get loans easily

- Being an active tax filer, you can avoid the extra charges and higher taxes compared to non-filers who face this issue.

- Your fax filer active status signifies that you are in compliance with legal requirements and have contributed to national development.

- Being a responsible citizen of Pakistan, you are well aware that paying taxes is a compulsory and legal requirement. Thus, by paying it consistently, you will be able to contribute to the country’s economic growth,

- If you pay your taxes on time, you will be safe from penalties.

- Firms or contractors among the active tax filers will be able to open themselves up to massive business opportunities which are not accessible to non-filers.

- By consistently paying your taxes, you will help the nation get funds that will contribute to the country’s development.

- Paying tax on time ensures you are listed among the active tax filers. This public record maintained by FBR is crucial for different tax-related advantages you might require for certain financial transactions.

Conclusion

How to Become tax filer in Pakistan is simpler than you think and the benefits are worth it! From lower tax rates to access to loans, filing taxes opens doors to financial opportunities. Follow this guide, take the first step, and join the ranks of responsible taxpayers today. Moreover, you can also read the difference between filer and non-filer in pakistan. Let’s build a stronger Pakistan together! So, we at Nexus Ideas recommend you be a responsible citizen of Pakistan and follow each method and step to become a tax filer easily.

Frequently Asked Questions (FAQs)

Below are the FAQs about how to become a tax filer in Pakistan:

Q1: What is the benefit of filer in Pakistan?

Ans: The filer benefits in Pakistan include lower withholding tax rates, eligibility for several tax exemptions and deductions, an opportunity to enhance your credit rating and get loans, etc.

Q2: How to check active taxpayer status?

Ans: To check the active taxpayer status, open the FBR site and type NTN verification. Now, click on Online Verification System FBR and click on Active Tax Payer List. Next, enter your CNIC no, registration no, and date. Enter the CAPTCHA code and click Verify option. This way, you can get to know your status.

Q3: How to know my NTN number?

Ans: If you want to know how to find NTN number online, then open the official website of FBR and enter your details like CNIC number, registration number, and date. After that, you will see Reference No, so understand it is your FBR NTN number.

Q4: How to check if I am filer or not in Pakistan?

Ans: If you are wondering how to check you are filer or not, then checking the official FBR website is the best way to know whether you are an active filer in Pakistan.

Q5: How to become a filer in Pakistan?

Ans: If you’re looking to learn how to be a filer in Pakistan, follow all the methods mentioned above in detail in this blog.

Q6: What are disadvantages of being filer in Pakistan?

Ans: Everything has its pros and cons. However, becoming a tax filer in Pakistan also has some disadvantages, such as disclosing financial data, tax liability, possibility of audits, etc.

Q7: Who is required to file income tax return in Pakistan?

Ans: Any person who wants to start a startup or businessman who wants to run their business smoothly must file an income tax filer return in Pakistan.