Introduction

Getting to know the difference between filer and non-filer 2025 is crucial for every individual residing in Pakistan. Every year, the government introduces a finance bill that deals with taxation, showing the tax rates of every person. Considering that all the people are required to pay their taxes on time to get massive benefits.

However, those who pay their tax return on time are considered filers, and in contrast, those who fail to pay taxes are considered non-filers. Unlike filers, non-filers are subject to many consequences that might affect their lives and businesses’ overall performance and growth.

So, if you don’t want to face any issues or penalties, make sure to check out the blog till the end to get insights into the difference between filer and non-filer 2025 and how to become a filer In Pakistan In 2025. After knowing the differences, you’ll surely be able to make a wise decision.

What is Filer and Non-Filer

If you are wondering who is a filer or who is a non-filer, then check out the difference below:

Who is a Filer?

The Filer refers to a person or firm who is officially registered with the Federal Board of Revenue (FBR) and regularly files income tax returns. Moreover, filers are the people who are listed on FBR’s Active Taxpayer list, signifying they are eligible for financial and legal advantages. Additionally, if you are wondering who qualifies as a filer in Pakistan, then check out below:

- People who earn an income exceeding PKR 600,000 annually must file their tax return.

- No matter whether a person has a small shop, an individual has an online business or works as a freelancer, they are also required to file their tax return if their income is taxable.

- If a person owns a property or vehicle above a certain value, filing taxes is necessary for them to benefit from it.

- Tax filing is crucial for every individual as it will protect them from extra charges or deductions on their profits in case they invest in stocks, real estate, or even mutual funds.

- Being a tax filer benefits people who receive a huge amount of money from abroad through official banking channels, as they can easily justify their income and also avoid being under examination.

Who is a Non-Filer?

On the other hand, non-filers refers to individuals or businesses who do not pay their taxes to the government. However, there are different reasons why non-filers don’t pay their income tax returns:

- There are some people who are actually not aware of if they really need to file taxes.

- Some people might find the filing process confusing and technical, so they might avoid paying the tax for a while.

- People might be unaware of the advantages of being a tax filer in Pakistan.

- Some people do not actually want to show their income records.

- People also remain non-filer as they don’t want to face extra deductions like fines.

- Doubts regarding how tax money is used also discourage many people from filing tax returns.

- Some individuals also delay filing taxes, and as a result, they unfortunately miss the deadline.

Difference Between Filer and Non-Filer in Pakistan 2025

Have a look at the difference between filer and non-filer in Pakistan 2025:

1. Definition

- Filer: A filer is a person and business registered with the FBR who complies with tax regulations and also has a national tax number (NTN).

- Non-Filer: A non-filer is a person or firm who does not file income tax returns and does not comply with tax regulations. They also don’t have an NTN and are not on the FBR’s active taxpayers’ list.

2. Tax Rates

- Filers: Filers benefit from lower tax rates on different financial transactions, like withholding tax on banking transactions, property transactions, and vehicle registrations.

- Non-Filers: Non-filers are required to pay higher tax rates, as the government imposes extra taxes on them

3. Financial Transactions

- Filers: Filers enjoy lower withholding tax rates on cash withdrawals and other banking transactions. Despite that, they also have lower tax rates on the purchase or sale of property, along with vehicle registration and transfer fees.

- Non-filers: Non-filers are subject to face higher withholding tax rates on cash withdrawals, property transactions, and higher registration & transfer fees for vehicles.

4. Banking and Investments

- Filers: Filers have the benefit of enjoying lower withholding tax rates on profits that they get from savings accounts, fixed deposits, and other investments.

- Non-filers: Non-filers, on the other hand, must face the consequences of higher withholding tax rates on their savings and investments.

5. Property Ownership

- Filers: Filers can easily own a property of their choice with lower tax rates, allowing them to lessen the overall cost of property transactions.

- Non-filers: Non-filers are required to pay higher taxes if they want to purchase or sell property, making it more costly.

6. Vehicle Ownership

- Filers: Filers can seamlessly buy vehicles with lower taxes and also need to pay lower fees when registering or transferring vehicle ownership.

- Non-filers: Non-filers need to pay higher registration and transfer fees, making vehicle ownership more expensive.

7. Business and Trade

- Filers: Filers can start their own business or franchises as they have the advantages of lower tax rates on different transactions, including import and export duties, making their business operations more cost-effective.

- Non-filers: Non-filers who own businesses are subject to higher tax rates and face additional inspection, which, as a result, impacts their profitability and the business’s overall performance.

8. Access to Financial Services

- Filers: Filers can access financial services, including loans and credit facilities. They can easily apply for loans from any bank or financial institution.

- Non-filers: It is difficult for non-filers to secure loans from any bank or other financial institution because of their non-compliance with tax regulations.

Why is it Important to Be a Filer?

As clarified, being a tax filer in Pakistan comes with massive advantages that can hugely impact your personal and professional life. The major benefit of being a filer in Pakistan is that you can benefit from lower taxes on vehicle registration or property deals.

However, if you don’t pay your taxes on time for any reason, you might face heavy fines or even penalties which might bring you huge losses and problems. So, be wise and pay your tax returns in a timely manner to live a happy and comfortable life, dismissing penalties and fines.

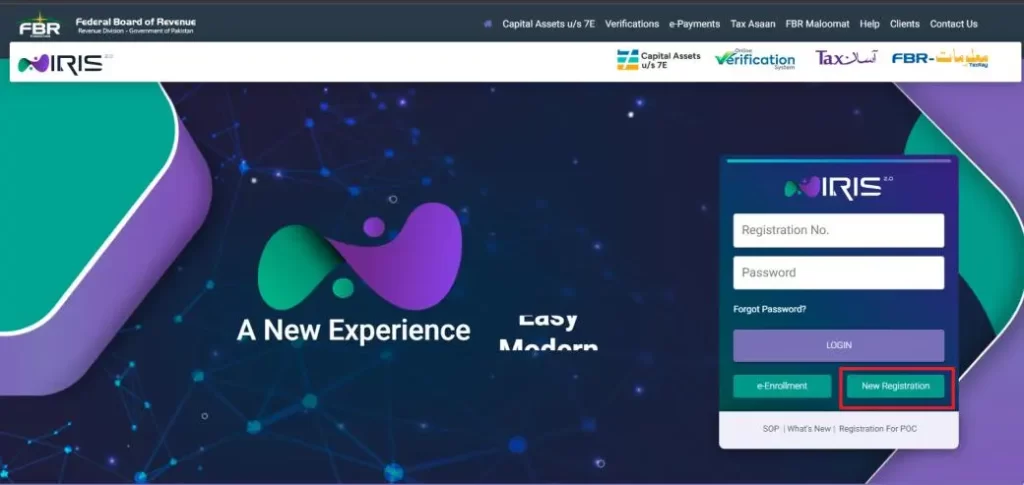

How to Become a Tax Filer?

If you are wondering how to become tax filer in Pakistan 2025, then there are basically two ways to become a tax filer in Pakistan:

If you are wondering how to become tax filer in Pakistan 2025, then there are basically two ways to become a tax filer in Pakistan:

- Visit the Regional Tax Office

- Online Registration

Additionally, manually, all you need to do is visit your nearest regional tax office and fill out the National Tax Number (NTN) form. After that, make sure to submit the needed documents like:

- Computerized National Identity Card

- Bank Statement

- Proof of Residence

- Employer Certificate (if you are an employee

On the other hand, you can also become a tax filer by going through an online procedure. Just open the official site of the FBR, log into the FBR IRS portal, and then fill out the online form for tax filing. After that, the FBR will issue the NTN number, which is known as the CNIC number.

Benefits of Becoming a Tax Filer in Pakistan

The following are the advantages of becoming a tax filer in Pakistan:

- Property Transactions: Filers pay a withholding tax of 1% of the property’s value. On the other hand, the non-filers pay a 2% tax.

- Vehicle Registration: Filers can benefit from the lower tax rates on vehicle registration. For instance, the tax rate for filers registering a 1000cc car is PKR 10,000.

- As a tax filer in Pakistan, you can enjoy lower withholding tax rates on transactions, including banking, property, and vehicles.

- Being a tax filer allows you to get numerous tax exemptions and deductions.

- Being a filer will help you improve your credit rating and easily get loans.

- Being an active tax filer, you are not required to pay any higher tax returns or penalties.

- Your tax filer active status indicates that you obey legal requirements and have contributed to the country’s development.

- The major benefit for the filers is that they can easily open their franchise or businesses that are inaccessible to non-filers.

- Consistently paying taxes on time will make sure you remain on the FBR’s active tax filers list for a long time. Your this public record will bring you various tax-related benefits you might need for certain financial transactions.

Consequences for Non-Filers

There are numerous consequences for non-filers if they refuse or don’t pay taxes:

- The non-filer might face some limitations when purchasing properties.

- Non-filers are required to pay a huge amount of money to purchase vehicles.

- Non-filers will face increased tax rates on different financial transactions, like purchasing property, cars, and banking transactions.

- Unfortunately, telecom operators are asked to block the SIM cards of the non-filers who have not paid their tax returns.

- Non-filers must also pay higher taxes on banking transactions. They are charged around 0.6% tax on cash withdrawals exceeding Rs. 50,000 than 0.3% for filers.

- The government is now imposing huge penalties on non-filers. FBR has the authority to take legal action, which can lead to the seizure of undeclared assets or property. Non-filers are required to pay huge fines, with penalties ranging from Rs. 5,000 to Rs. 200,000. However, the penalties depend on the nature of the violation and the amount of tax the non-filers have not paid.

- The government has also imposed restrictions on buying tickets for international travel for non-filers.

- Non-filers also find it difficult to get visas for certain countries, specifically those nations that need proof of tax compliance as part of the visa application.

- The non-filers won’t be able to take on any government contracts and tenders.

- Non-filers cannot apply for loans or credit facilities from banks and other financial institutions until and unless they pay their tax returns.

Frequently Asked Questions (FAQs)

Below are the FAQs about the difference between Filer and non-Filer 2025:

Q1: Who is eligible for filer in Pakistan?

Ans: Individuals who are earning over a certain amount (for example, PKR 600,000 per year).

Q2: What are the benefits of filers in Pakistan?

Ans: Filers can benefit from cash withdrawals of more than Rs. 50,000 in a day, whereas non-filers are required to pay 0.6% tax.

Q3: What is the disadvantages of non filer?

Ans: Non-filers must pay higher withholding taxes, which significantly raise the cost of transactions such as property purchases and vehicle registrations.

Q4: What does the NTN stand for?

Ans: The full form of NTN is the National Tax Number.

Q5: What is the difference between filer and non-filer tax?

Ans: Filers pay less tax on property purchasing and house renting than non-filers.

Conclusion

The blog has covered comprehensive details regarding the difference between filer and non-Filer 2025. However, now that you are well aware of the benefits and consequences, Nexus Ideas recommends that it is time for you to be a responsible citizen and file your tax return to benefit yourself and the nation.

Your tax return will bring Pakistan a good fund that they can use to enhance the country’s overall growth. So, hurry up, do it fast and contribute to the country’s progress. However, if you are a filer and want to invest in real estate, check out these options: ParkView City Islamabad Town Houses and Blue World City Legends Enclave.